6 Major Factors That Stack the Financial Deck Against Women (Part 1)

This is Part One in our two-part series. Click here to jump to Part Two: Motherhood and Aging Parents.

Part One: Childhood Through the Workplace

Once we start paying attention, we can find some version of the “pink tax” lurking everywhere. Over women’s lifetimes, this pink penalty can seep into education, workplace stereotypes, gender norms, beauty/glamor culture and healthcare. The good news is women can make conscious choices to carefully maximize their chance of winning no matter what the cards say.

#1 Beauty: From Childhood Women Are Taught What Beauty Looks Like

From the moment we can fit into a dress many women are being taught what beauty standards are and how to obtain them. This leads to an interest/borderline obsession with looking a certain way to parents, peers, and to men. We learn to value the importance of our looks over our intellect or intrinsic worth.

Over the course of our adolescence and adulthood we develop a strong desire to acquire the latest standard of beauty whether it be make-up, clothing, or even cosmetic procedures. It’s called the “Insta-perfect” lifestyle and it leads to massive amounts of credit card debt.

Image-boosters such as plastic surgery, Botox, weight-loss schemes, hair coloring/styling, manicures/pedicures and waxing add up to one whopper of a pink tax. Those of us who like expensive shoes, clothing and even cars can also rack up substantial debt in pursuit of a perfectionistic image. Such expenditures often lead to disempowering credit-card debt.

Recommendation: Connect to Your True Needs & Wants before Chasing Beauty Culture.

Counter this internal dialogue with a strong mindset of gratitude for what we have. When we get in touch with our true needs and wants, external posturing starts to fade into the background. Think about what needs and wants may lie underneath your craving for new clothes or makeup. Find healthy, creative alternatives to nurture those needs and wants for less.

#2 Education: “Women Belong in Nursing and Education, not Engineering or Finance”

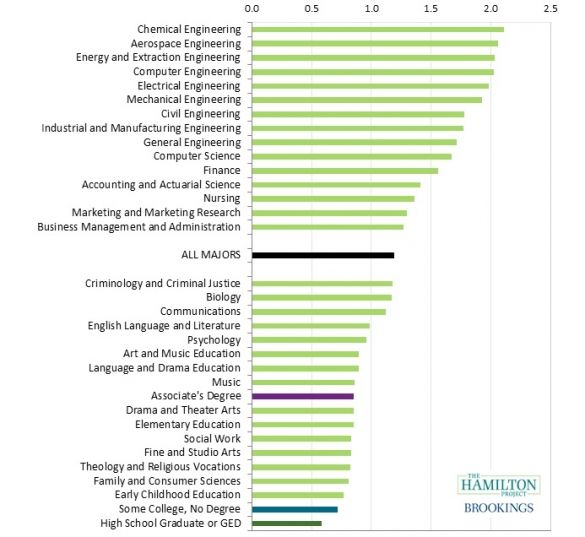

Women gravitate toward lower-earning professions than men.* Women also carry higher student debt loads for longer periods than men. Of the nearly $1.6 trillion dollars in student loan debt, 2/3rds is held by women.* This disproportionate student loan debt is a symptom of an education system that funnels women to lower-earning professions that still carry a large educational price-tag.

*Source: HBR: Women Dominate College Majors That Lead to Lower-Paying Work

Recommendation: Be Selective, Go to Community College, and Graduate without Debt!

If you or your children have not begun college yet, carefully consider the major, school, and method of financing higher education.

Pick a major that leads to a higher-paying job. Think of money as a source that enables you to meet your highest needs and wants. Choosing a major or profession because “I want to” reflects a naïve and child-like mentality. Job satisfaction, fulfillment, and meaning are important considerations when considering a major. A more mature, realistic approach considers lifetime earnings. Depending on your lifestyle choices and cost-of-living, you may graduate college with a large student debt bill and go further into debt because your profession doesn’t pay enough.

Source: Hamilton Project: Major Decisions: What Graduates Earn Over Their Lifetimes

Go to community college first. Once you’ve picked a major you may want to complete your general education at a community college. Community colleges offer a smart way to bring down the stratospheric cost of higher education. The cost of tuition and fees for a public 2-year college is one third the cost of a public 4-year university.

This can mean an annual difference of $3,440 for community college and $32,410 for a private university, according to College Board. Considering these astronomical costs, many students would be better off completing a two-year program or general education at their local community college and then transferring to a university to finish their degree. If you’re considering this, make sure ahead of time that your credits and degree will transfer to your chosen 4-year college.

Pay as you go. The best-case scenario for your higher education is to graduate with no student loans. It may not always be possible but if you’re knowingly choosing a profession that has low earning ceilings, you owe it to your future self to graduate debt-free. Many no-interest and non-loan financial aid programs can help. Also, holding down a job to pay for college while you earn your degree can set you up for long-term success!

In short:

- Choose a major that will turn into a profession you actually want to do and will pay enough in lifetime earnings to easily cover any student loans.

- Consider starting at community college and transferring to a college or university.

- Avoid student loans altogether by working your way through college, taking fewer classes each semester, and applying for scholarships and grants instead of loans.

#3 Workplace: Pressure on Women to be Agreeable and Avoid Conflict Leads to Lower Pay

Stereotypes persist about men and women in the workplace. Men are ambitious, women are bossy. Men are assertive, women are bitchy. Acutely aware of these stereotypes, women often avoid confrontation and even assertiveness.

As such, we're less likely to ask for a raise or even discuss our salary. Our moms taught us that it wasn’t “polite” to talk about how much money people made. So, by training, many of us are discouraged from advocating for correct and fair pay. Sixty percent of us say we’ve never negotiated for our salaries. It’s no surprise that 72 percent of us end up making lateral moves in order to get a raise.[1]

Recommendation: Make the Taboo Normal and Always Counter-offer Your Raises

Openly discuss with your friends, business contacts or even your colleagues how much money you make. This is a great way to help even out the great imbalance of power between employer and employee.

Always counter-offer a compensation package or raise. Always. Even if it’s not a large counter-offer or even if it’s rejected, you’ll still boost your self-confidence. It’s crucial to set an early precedent with your employer that you’ll always advocate for yourself. This self-confidence inspires respect.

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.